CalHFA are establishing yet another booking procedure getting Phase dos away from the fresh CalHFA Dream For everybody Shared Adore Mortgage System to include more hours to access the application and make certain an equitable shipment away from loans. CalHFA anticipates you to need for Dream For everyone Phase dos usually surpass available resource and will play with good randomized solutions way to procedure DFA Coupon codes to candidates.

Prospective homeowners will be begin immediately to do business with an approved financial to obtain their called for documents ready to sign up for good DFA Coupon through the pre-registration portal. Usage of brand new CalHFA Fantasy for everybody Mutual Admiration Loan site usually unlock to your Wednesday, , during the 8 an effective.m. PDT, and certainly will undertake software up until 5 p.meters. PDT with the Friday, .

In case your software program is pulled and also you discovered an effective DFA Discount, there will be 3 months buying a home, go into a contract to acquire a house, and also for the financial in order to set aside the borrowed funds due to CalHFA’s Financial Accessibility Program (MAS).

In the news

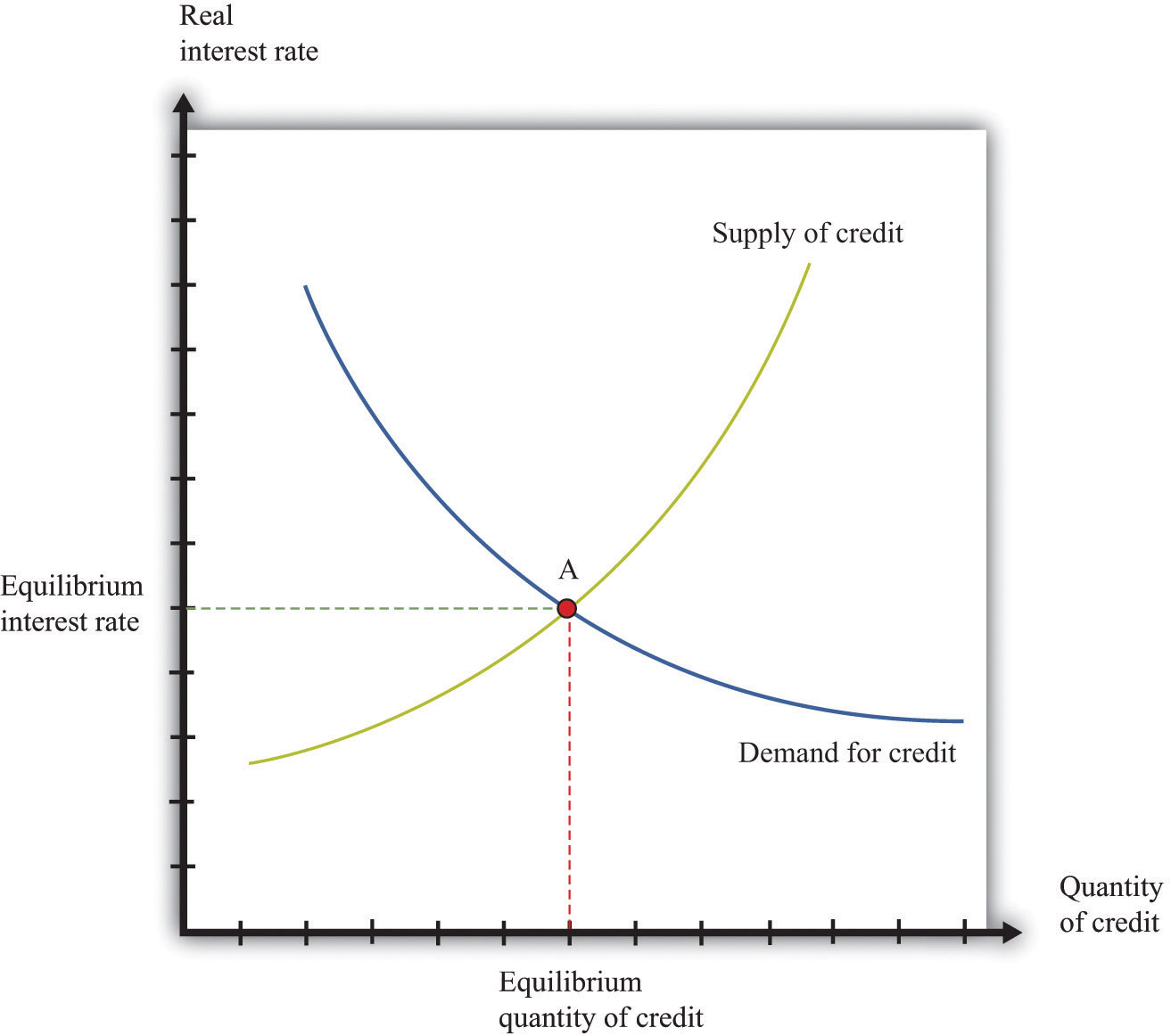

Getting money-eligible people, this new CalHFA Fantasy For everybody Mutual Love Loan also provides a no-interest mortgage https://cashadvanceamerica.net/loans/im-in-desperate-need-of-a-loan-with-bad-credit/ to hide to 20% of the purchase price away from a new home. So it goes with a conventional mortgage which covers the remainder purchase price of the home.

The new homebuyer does not need to lower one portion of new State’s deposit financing whenever you are staying in new household. Although not, abreast of purchases otherwise transfer of the home, the fresh homebuyer will be required to settle CalHFA the degree of the original advance payment mortgage. As well, if for example the possessions expands for the worthy of over the years, a fixed percentage of the house’s appreciation should getting reduced.

If the CalHFA program first exposed during the , the state allotment regarding $3 hundred mil is actually fatigued when you look at the eleven months, evidence of extremely high need for which well-known system. Next time the CalHFA system opens up a bit into the $250 million is offered.

Rating informedIf youre intent on this choice, it is strongly suggested you take strategies accomplish every standards immediately to be willing to submit an application in the event the program re also-opens.

Quick Summary

- Look at the Fantasy For everyone Mutual Prefer Mortgage webpage to read through a complete conditions and acquire info.

- Register for the fresh CALHFA newsletter to receive condition, along with in the event the system commonly discover. CalHFA offers an upgrade soon that were a schedule getting apps.

Brief Summation

- Have there been eligibility standards?

- Sure, you must satisfy CalHFA’s money requirements

- Yes, you must complete homebuyer education and you may guidance courses ahead of distribution your application!

Quick Summation

- Precisely what do I need to manage on employment confirmation?

- Within the financing process, a job confirmation are required. The fresh College of California uses The work Count to have work confirmation. Make sure to visit the Functions Matter ahead setting up your a career confirmation account. You may need this new College or university of Ca Manager Password: 15975. To have mortgage-related concerns, excite consider CalHFA’s info otherwise pose a question to your bank.

Disclaimer: Please remember that this isn’t good results provided because of the UC Davis. CalHFA are an application given by the state of Ca to own the entire populace from the State that is a course one is not affiliated with, supported, otherwise backed by the UC Davis. Real estate is actually an individual alternatives and you will any curious professionals would be to separately review and you may take a look at the this option to ensure they matches its need.

UC Davis makes staff aware of other household-to invest in solutions because they be available. The brand new CalHFA Fantasy For everybody Shared Prefer Financing is one chance worth evaluating.