We dream of running their home, however, preserving the bucks you want for the dream home can getting challenging. The new ascending price of houses all over the country is actually hampering industry, and purchasing property requires careful monetary believed. Yet not, first-go out home buyers into the Missouri have multiple information available to assist guide all of them through this active procedure.

Below, i information four first factors to bear in mind since you initiate their Missouri family appear and have now you one step closer so you’re able to becoming a primary-date resident.

step one. The important Behavior

What are the requirements to shop for a home during the Missouri? When you’re exploring the market for the first time, a proper-designed monetary package and you can a great down-payment are essential. Here are particular solutions to make it easier to safe very first family in the place of damaging the financial.

To create a proper funds, calculate your own month-to-month house money shortly after taxation, then suits they toward monthly costs. Endeavor to possess an excess every month (regardless of if 64 percent out-of Us citizens real time paycheck to help you salary, centered on that statement). If you don’t have some sufficient to kepted coupons for every single times, work through your financial budget to obtain one things you can cut straight back on to enhance their deals.

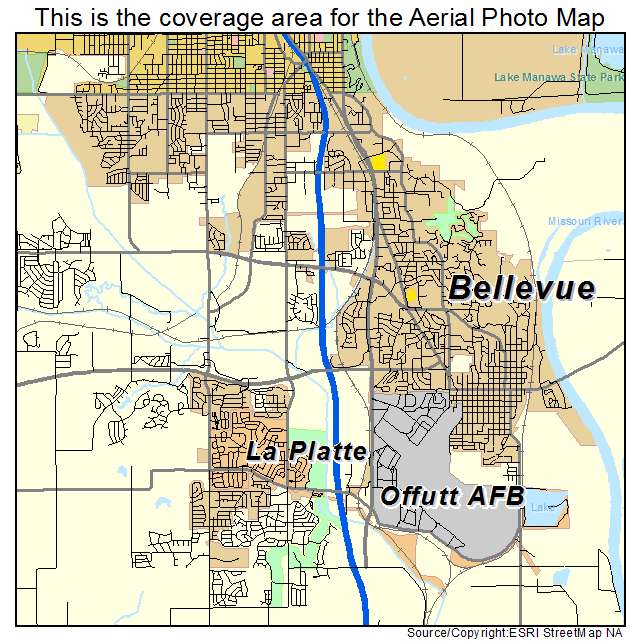

In your house-to acquire budgeting processes, determine what their address amount is for a down payment. Start by looking online observe just what property rates appear to be close by.

A deposit is actually proportionate to the cost of a property. Within the the greatest globe, property owners will pay 20% as a down-payment. Lenders typically use this number given that a limit since it gives all of them sufficient influence if you can’t spend your own mortgage.

While you are committed to getting off 20 percent, their downpayment finance will establish the maximum amount you will be in a position to invest with the family. A 20 percent downpayment in addition to helps you save regarding being forced to purchase an agenda one to protects the bank regardless of if of a foreclosures (much more about you to shortly). If you possess the financial means, select this number when you find yourself strengthening the discounts.

2. The newest Options

Certain types of mortgages focus on particular users into the unique affairs. Just a few consumers be eligible for such fund, nonetheless it will probably be worth because of the after the solutions:

Government Construction Management (FHA) Financing

A federal Casing Administration (FHA) mortgage try that loan product which could be appealing to first-time homebuyers due to the lower income constraints or any other criteria. These loans, which are covered by the FHA, provide reasonable- so you can reasonable-money borrowers having fund that produce owning a home a lot more available-even though you have less-than-best credit. These types of fund also offer a minimum deposit as low as step 3.5 % of home’s worthy of. Missouri FHA mortgage restrictions will vary by the condition, but every unmarried-nearest and dearest residential property in the Missouri be eligible for home loan wide variety doing $472,030 in loans supported by the FHA.

Military Seasoned Funds

If you find yourself an army seasoned, you could be eligible for unique Experts Affairs funds otherwise provides you to definitely render private cost and terminology towards the mortgage loans. These types of financing applications actually were home loan products that don’t require people deposit after all.

Guidance Software to possess Basic-Day Homebuyers inside Missouri

The fresh Missouri First-Date Homebuyer Savings account was created to have very first-date home buyers in Missouri to assist them conserve to have a beneficial brand new home. This new step allows you to deposit up to $step 1,600 each person (or $step three,200 to have lovers) regarding immediately following-taxation cash a-year and you will discover 50 % away from your state taxation to your count transferred. All the accumulated appeal towards membership are tax-liberated to rescue getting a down payment. Moms and dads and you can grandparents may arranged a be the cause of their students and you may grandchildren. Missouri very first-day homebuyers may also speak about some most other state-particular loan selection provided by the Missouri Construction Advancement Percentage.

step 3. The other Considerations

The latest nearer you are able to arrive at one 20 percent off commission threshold, the greater their mortgage payment choices was. But when you are unable to slightly struck you to draw, don’t care. Of many lenders loan places Paoli provide independency to financing your house buy.

Spending money on Personal Home loan Insurance rates (PMI)

Even when it’s possible to pick a property as a result of a normal mortgage with lower than 20% down, consider the called for additional cost regarding individual mortgage insurance rates (PMI). PMI is a protect used to protect lenders even in the event brand new purchaser can’t shell out their financial. Instead of utilizing the advance payment because influence, homeowners get plans that will compensate the lending company in the function away from foreclosures.

PMI try put in the mortgage before the collateral about home is better than 20 percent, of which part the insurance is removed. Property owners do this by creating regular monthly installments, carrying out home improvements, otherwise sense an increase in the fresh residence’s reviewed well worth.

Making the most of Your finances

Since you always save yourself to have a deposit, you will need a rut to keep your own offers and optimize those funds. We recommend your get involved in it safer by avoiding risky investment. Choose a reliable, interest-bearing bank account or currency sector membership. Assets would-be glamorous, specifically now. Although not, it seldom pay off for the short term and may impact in the a significant losses that may be hard to get over. Nevertheless they aren’t covered, in lieu of a bank checking account.

Once you have ideal checking account create, initiate putting away bucks towards the down-payment. Among the many easiest ways to store is through cutting down with the people too many otherwise a lot of expenses. Use the home funds your built to pick unnecessary costs your can possibly lose.

In the event it appears impossible, seriously consider to acquire a property as opposed to investing lease. Especially because a first-go out home client, advantages are worth the new upwards-side cost. Several benefits of to order more renting include:

- Putting on taxation advantages, such tax loans

- Which have do it yourself alteration possible

- Obtaining an asset which have admiring well worth

- Having the latest pleasure away from home ownership

cuatro. New Legitimate Lover getting First-Day Homebuyers in Missouri

While preparing to purchase a house regarding Reveal-Myself State, definitely partner that have regional lenders you can trust and you may discuss practical mortgage alternatives. The most important step try choosing a property that meets their family members’ means as well as your personal choices. You can study a little more about the new particulars of Missouri home buying by getting our very own free guide, All you need to Discover Home loans within the Missouri.