Imagine a link Mortgage inside the an excellent Seller’s Sector: Inside an excellent seller’s field, in which qualities are providing easily, temporary money can provide a competitive border. By the protecting instant cash flow, you could make a robust bring with the another household, potentially boosting your chances of securing your ideal possessions.

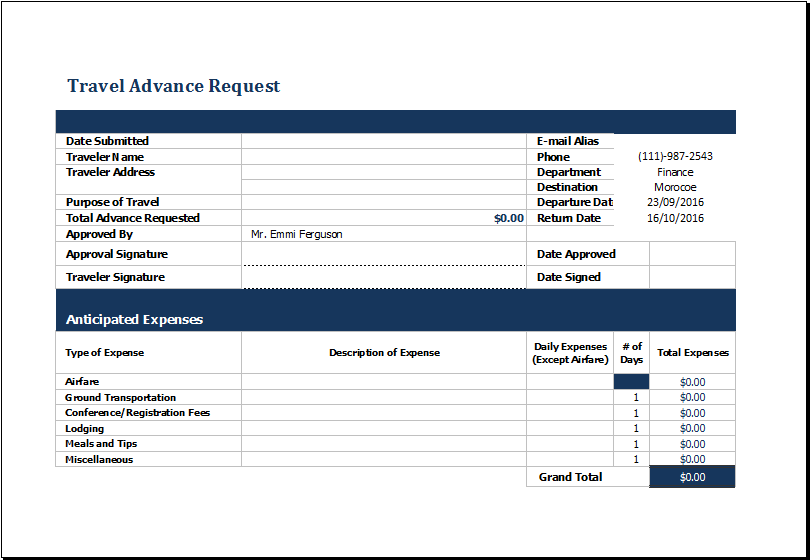

Offer direct economic pointers

Right monetary information is crucial for a profitable application for the loan. Be prepared to provide proof money, an excellent expenses, or other relevant monetary data to support your loan app.

Correspond with the financial

Open communications with your bank is vital. Be sure to comprehend the fine print of your loan and ask any queries you have. Your own financial offer valuable recommendations throughout the loan processes.

Consider your month-to-month finances

Prior to investing home financing, carefully take a look at their monthly budget to ensure you could comfortably manage the fresh new monthly payment. Financial support should not set tall monetary stress on their month-to-month finances.

Really does credit rating contribute to securing a connection financing?

It is well worth listing you to definitely bridge fund fall under short-term capital, and as a result, the credit rating requirements may possibly not be because the tight as it might possibly be getting a traditional mortgage. Although not, good credit has been an asset whether it pertains to protecting a mortgage.

Should your credit score is gloomier, it generally does not indicate you’ll not qualify for a connection loan. Some loan providers promote connection financing choice specifically made for folks having all the way down credit ratings or faster traditional credit histories.

Making Your following Monetary Move that have Bridge Fund

To close out, an owner-occupied bridge mortgage are going to be a valuable money option when it pertains to to make the next monetary disperse. Whether you are to invest in an alternative home, an additional household, otherwise you desire short term property, bridge resource even offers immediate cash move, bridging the newest gap between your latest home income and you may new home buy. Simply by using temporary investment, you could safer your perfect household without any economic load out-of juggling a couple of mortgage loans.

These financial support bring an adaptable resource alternative, letting you bridge new gap between your newest family profit and new home get, bringing a delicate change on your own real estate travel. Which have immediate cash flow, homeowners can take advantage of business potential, secure a different house, and steer clear of the pressure out of time a property purchases well. From the expertise conditions, interest levels, credit score criteria, and costs associated with connection financing, you could make a knowledgeable choice from the whether or not here is the correct fit for your financial need.

Regardless if you are thinking of buying another household, secure short-term housing, or put money into the next property, brief financing provide the financial service need, enabling you to build your next move with certainty.

Is actually a brief link mortgage high risk?

Connection finance can be considered greater risk compared to the antique funding because they are typically brief-label, provides large interest rates, and can even want guarantee. The chance regarding the short term financing primarily is inspired by the fresh brief cycle together with possibility a debtor in order to default for the repayment. not, link finance can also be a helpful product for individuals or organizations in some situations in which they want quick funding prior to protecting long-label money.

- As soon as your most recent residence is sold, brand new proceeds are used to pay brand new “new” mortgage. That it implies that their link loan is actually a short-term services, having a very clear leave approach once your family marketing is done.

Stress-100 % free Change: In some instances, you will need brief casing when you are awaiting your house pick to get finished. Pursuing the purchase of good “new” domestic, individuals are selling the current domestic during the an even more leisurely pace. They does away https://cashadvancecompass.com/loans/balance-transfer-loans/ with be concerned of obtaining to handle multiple moves and you will allows them to have the best price on the established home. This may offer reassurance and you will convenience into the changeover months.